Next up we have a talk on BI Maturity Models from Elsa Carduso of University of Lisbon, Portugal.

Elsa again kicks off with her own definition of Business Intelligence based on enhancing enterprise decision making capability. She also notes the distinction in time frame in that BI tends to give insight based on what has happened in the past. We also need alerts regarding real time present. In terms of future we’re into the realms of predictive analytics. Jisc did some work on this in 2013.

So, on with BI Maturity Models. Elsa states that these are usually used to analyse the ‘as is’ situation in terms of organisational (and individual?) capabilities to undertake BI. There are many BI Maturity models but EUNIS has focused on the OCU BI Maturity Model. I can’t find this anywhere other than on our site but I think it’s been updated since we published.

Reporting on the recent EU wide survey in order to give an indication of the As Is situation and identify gaps and hence potential offers to help out.

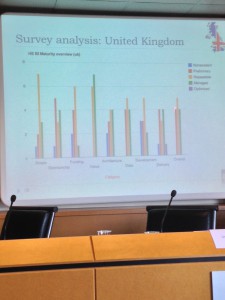

The survey had 66 respondents across 9 countries. 13 responses from the UK, 12 from France.

26% have no dedicated BI staff which maps well to the number of respondents having no BI capability! On profile of respondents 50% were from IT which either echoes that BI tends to start there, or that the survey was targeted that way. In the UK it went out through the University and Colleges Information Systems Association UCISA.

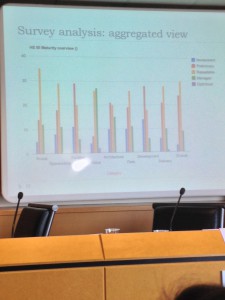

Anyway, responses aside, there are 9 dimensions to the model and 5 levels of maturity (see previous link for a diagram but below diagrams have summaries of findings). Elsa outlined the questions within the survey. I can’t find those but here’s the rational.

There are representations of the analysis for each country polled. Within that Jisc / HESA / HESPA BI project we’re considering how we can best use maturity models. Current thinking is we should stick with the OCU one and encourage UK institutions to create a picture of the ‘as is’ to give us a snapshot of capacity to assist different aspects of the project, as well as profiling out our potential customer base. I’m also interested in how we might work with institutions to play with the ‘to be’ state. What are their aspirations mapped to show how the new BI service can assist in the transition. Key to this I think will be something I’m calling satellite services for now. These will be broad covering advice, case studies, training master classes, working groups and maybe even on site consultancy offers.

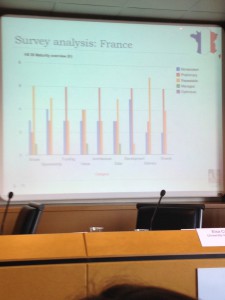

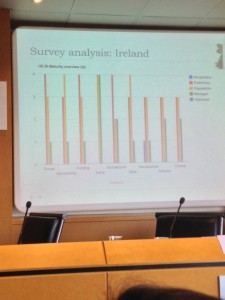

Anyway, back to the survey. We’re being shown examples of survey analysis by country. It’s a little like Eurovision. Am afraid I missed a few of these (Germany, Finland to name but two) Elsa suggests benefits in delving deeper to determine why results are as they are. Here’re a few examples;

Aggregated

Sweden has problems with funding yet all respondents have each of the capabilities. There’s no indication of why.

France has a good deal of BI activity with non existent provision yet delivery and overall are high.

Ireland managed to make 8 returns yet has only 7 public universities. Some problem with the underlying data?! The picture here looks rather rosy, yet opinions varied in the room

Drum roll please as we reveal the UK;

EUNIS are keen to engage better with the UK. Indeed I’m the only British delegate.