It’s been a while since I attended an event so today I’m dusting off the cobwebs from this site and will attempt to live blog a few sessions from the first annual conference of the recently convened Higher Education Strategic Planners Association (February 2014 at Warwick University)

Strategy Implementation in a changing world is the theme for the two days.

Full programme here

I’ve had some involvement with National Planners and Scottish Planners over the last 4 years through my Jisc work in Business Intelligence. I’m here today to meet members, understand the breath of roles and responsibilities. Understand members concerns and priorities to inform our relationship. I’m talking with the HESPA Executive Committee about their formal involvement in the development of a new Jisc Business Intelligence Service and see the delegates of this event as prime customers.

Session 1

Mary Curnock Cooke, UCAS so a talk on applications to HE and predictions thereof….

Mary highlighted the 2012 picture; the fact that fewer offers were made to fewer applicants. The net result was 50K fewer HE starters. In 2013 significantly more offers (up 8%) to slightly more applicants. Based on exam performance 95% got an offer 50% got four or five offers with BTEC making an impact (ABB were up 6% with 26% from BTECs while non ABB were 26% up so a quarter of ABB offers were to BTEC holders). The BTEC impact is a very significant impact. Nearly all institutions had offers available through clearing. The UCAS end of cycle report panted a very positive picture with 7 – 11% increases across recruitment, Widening Participation, no change in ABB entrants but significant rises in BTEC as mentioned.

UCAS are forecasting a 4% increase in overall applications in 2014 over 2013.

UCAS handled 92K applications in the last 48 hours of clearing. So best not to expect a quick response during those times!

Interestingly the recovery rates are lowest for those HEIs charging the lower fee rate, though UCAS believe this is more due to the economic state of the nation and employability rather than fee rates.

Some interesting regional variations in application rates with Yorkshire and Humberside topping the league being up by more than 7%, others flat.

A good deal of detail presented on the widening participation agenda. Applicant by women exceed men by 84K. Overall achievement in primary and secondary education being significant. The underperformance of boys vs girls is a concern UCAS are flagging. I wander how effective analytics could be in informing students, parents and teachers on the significance of school level learning indicators and likely entrance to higher education. Is there an opportunity to work cross sector on this? Are the indicators simply grade point averages or can we be smarter in these days of big data exploitation? For example UCAS note that applicants have lower GCSE attainment. The inference here is to look at level 2 (GCSE) attainment as a good indicator for success at higher level and therefore admissions should look closer at these.

On predictions only 60% ABB predictions achieved these. UCAS therefore recommend looking to GCSE attainment as a predictor. UCAS offer predictions up to 2018 – the big change in the pool form which HEIs recruit is a significant increase in vocational qualification entry with a drop in A level acceptance with the least advantaged groups holding the most vocational qualifications. It’s therefore getting harder to accept poor bright kids if looking to A Level only.

Next up the effect of lifting the cap on entrants to Higher Education. UCAS believe 20-25K more is achievable. The Government predict 60K. UCAS do not support this expecting maybe 30K more citing the requirements to help this as being extreme such as men to equal women applications, equalising across ethnic groups (white to achieve asian) a 50K increase, all regions to meet London increases etc. UCAS note a large number (>100K) applicants not accepting any offer. Is this an area to examine? Jisc has done a good deal of work on improving the student experience during pre to post admission phase (through to alumni) See our Relationship Management work for more on this (http://bit.ly/jisc_rm).

Some demand here for benchmarking opportunities against competitor HEIs. Jisc worked with UEL on Business Intelligence and created some excellent dashboards based on HESA data to achieve this. It’s the sort of thing we hope to include in the new Jisc BI Service. See http://bit.ly/jisc_bi and the Flikr collection for dashboard examples.

Session 2

Giles Carden (Director of BI at Warwick) introduced Dominic Shellard the Vice Chancellor of DMU

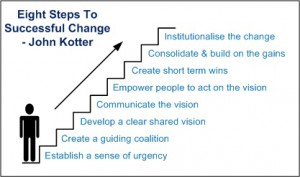

DMU was in trouble – over recruitment, zero reserves, staff costs highest in sector at 65% turnover. A new strategy was required. Dominic applied Kotters 8 point process to major change with significant success;

Following the success of this, DMU faced An ageing campus, failing ICT infrastructure, break even performance, low applicant to registration conversion. The focus become one of student experience enhancement through investment via a 100 million pound bond.

In summary;

Sensible growth with a focus on quality in all areas (NSS, retention. league tables, employability, research, partnerships) must be the way forward – any institution piling students high to the detriment of quality will get into serious trouble.

Differentiation (new initiatives and innovation to set apart from the competition) is key – DMU are tied to Leicester Tigers, Leicester City, British Airways for #dmuglobal There must be a strong brand with a focus on marketing. Sophistication in attracting home students is already high, but on EU students needs attention. Focus on customer service and the student experience.

Planners are key in advising where to focus resources and effort to make the mo st impact in these areas.

Quite the challenge!

Session 3

The Future of HE: A Policy View by Nick Pearce Director Institute for Public Policy Research

Nick kicked off with a consideration of Government spending cuts expecting 60% further cuts 14/15 to 17/18. Four scenarios were presented on BIS resourcing with cuts of 14.6% to 17.6% on BIS budget depending on the protection of NHS and Schools. Under all scenarios the impact is predicted at 24.8% cut on HE budget. Cuts to date have been somewhat offset by fees but noting that this is a long term strategy. The amount government will have to subsidise student loans is up to 35-40%.

On the expectation to expand on student numbers 720 million pounds is the figure quoted to achieve this. If this is to stand it needs to be funded by increased borrowing, cuts elsewhere, diverting funds or increases in revenue (tax).

A number of short term saving scenarios were subsequently presented. Technology could have a role to play and is perhaps an area for Jisc support.

Key policy challenges

delivering spending cuts to 2018/19

sustainability of loan system

address crisis in part time and pst grad study

expanding access traditional full cost vs low cost / vocational

maximise HE potential to drive growth

respond to disruptive innovation eg MOOCs and Private Providers